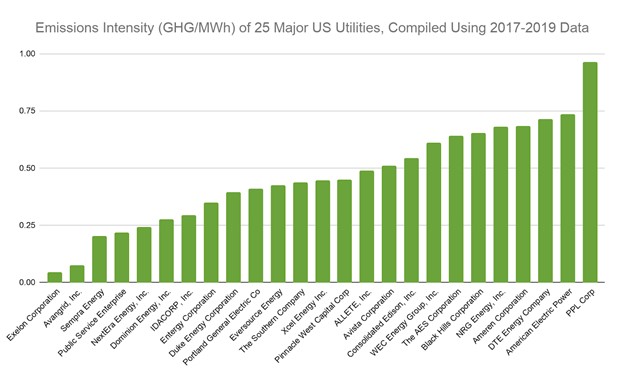

Late last year, when we set out to research where major utilities stand in terms of greenhouse gas (GHG) emissions, we were confronted with data gaps and non-standardized reporting that made a straightforward comparison of just how “clean” today’s utilities are seem out of reach. But after multiple dead ends, our research team found a solution: two simple data points that allowed us to produce a simple, elegant metric for comparison.

Working across several sources, including data published by investor advocacy network Ceres, a report from the industry association for utilities, Edison Electric Institute (EEI), and in some cases the utilities’ own annual 10-K disclosures to the SEC, we were able to quantify annual greenhouse gas (GHG) emissions for most major US utilities, and several European utilities as well. Our team then collected the more readily available annual total megawatt hours (MWh) of electricity generated by each utility, to allow us to normalize our figures. The result: a single ratio, known as “emissions intensity,” that allows us to compare utilities of different size and scale.

One of the first things that stood out to us in the US data was how gradual most of the curve ran between the companies. Utilities in the US are governed by a 100+ year old “regulatory compact” that legally protects them from competition. Because rates are also regulated—but utilities are generally permitted to cover their costs at a reasonable rate of return—additional profits typically come from new investment. Traditionally this has taken the form of new power plants and transmission lines, since, mandated with delivering low-cost electricity to consumers, the incentives for utilities themselves to produce clean energy have been scant. Even some that do appear cleaner in our analysis, e.g. Exelon, do so primarily because they are heavily weighted toward nuclear energy sources.

But some are outliers for good reason. PPL, formerly Pennsylvania Power and Light, relies heavily on Kentucky coal mines to generate its power. At the other end of the spectrum, Avangrid has divested nearly all its non-renewable generation. Perhaps more encouraging, every US utility we looked at has some form of clean energy target. Some are more ambitious than others, including four of the twenty-five we researched—Idacorp, Eversource, Avista and PEG—which all have time-bound goals for carbon neutrality and/or 100% renewable energy. But almost all major utilities are steadily divesting from coal. And with hopes for new regulation under the incoming administration, there is reason to think this positive momentum will only accelerate.

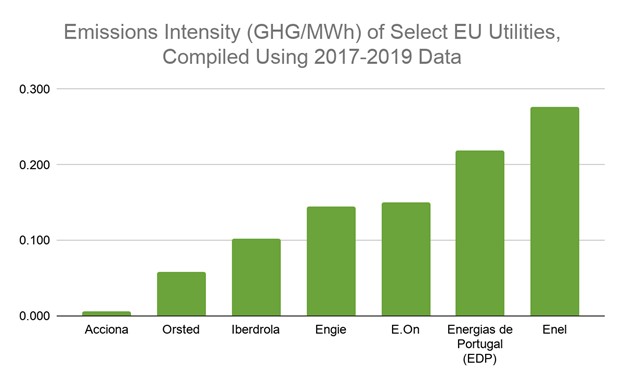

In Europe, that acceleration in momentum is arguably already underway. While our analysis of European utilities was smaller—we focused on those we already expected to be “cleaner” than their peers—it suggests that the seven that we researched had already reached a much lower relative baseline compared to those in the US.

The notable outlier here is clearly Acciona, a Spanish utility whose energy generation comes only from wind, hydropower, solar and biomass. But multinational, Spain-based Iberdrola (which owns US-based Avangrid) also boasts an impressively low 0.103 emissions intensity number considering its large scale. And many European countries, among them Denmark, Germany, Greece, Lithuania, Spain and the United Kingdom, are nearly at, or in some cases well over, 50% renewables in their energy mix even without major contributions from hydropower, according to a 2020 report by the International Energy Agency (IEA).

Our analysis of utilities demonstrates both heartening progress and major work that remains to be done. But with continued pressure from customers, investors, and, we hope, regulators, we see reason to believe that in the years ahead, utilities will finally rise to their rightful, central role in the fight against climate change.